Introduction

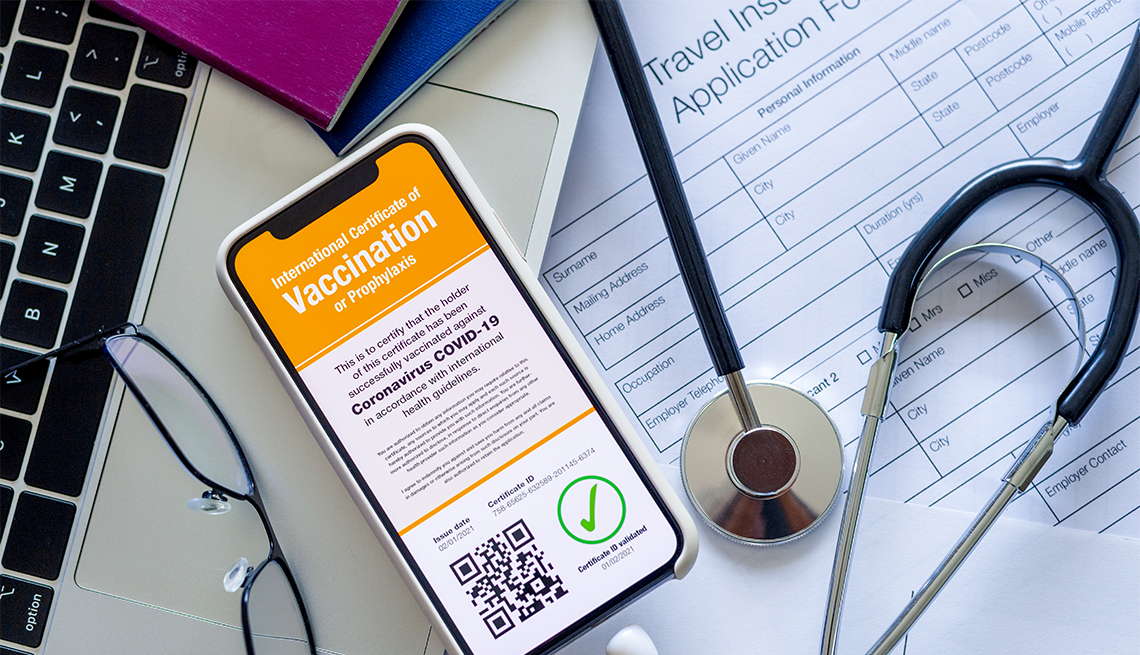

Travel plans are exciting, but health risks are always a concern. Especially with COVID-19 still making headlines, many travelers wonder if their insurance covers pandemic-related issues. As we move through 2025, the rules keep changing. Knowing what your policy covers now can save you big headaches later.

The Current State of COVID-19 Coverage in Travel Insurance

Overview of 2023-2024 Travel Insurance Policies

During the last couple of years, travel insurance shifted focus. Many policies added COVID-19 coverage as a standard feature. Some even offered special add-ons just for pandemic-related issues. As COVID-19 moved from a pandemic to an endemic (a regular part of life), insurers made coverage less generous but still present. Many policies now treat COVID-19 as a common health issue, not a special case.

Differences Between Standard and COVID-Specific Policies

Traditional travel insurance mainly covered things like trip cancellations due to weather or illness. It usually didn’t include pandemics. But, COVID-specific policies or riders add extra protection. These cover medical expenses if you catch the virus abroad, quarantine costs, and trip interruptions related to COVID-19. Knowing the difference helps travelers pick the right plan.

Industry Statistics and Consumer Trends

In 2025, around 70% of travel insurance policies include some form of COVID-19 coverage. That’s up from just 50% in 2023. Travelers are now more aware of health risks and look for policies that include pandemic-related protection. Demand for COVID-specific add-ons continues to grow, especially for international trips farther from home.

What Travelers Need to Know About COVID-19 Coverage in 2025

Are COVID-19-related Claims Still Eligible?

Yes, but it's not automatic. Many policies still cover medical bills if you get COVID-19 abroad, but some have limits. For example, some deny claims if you're traveling to areas with high infection rates or if you aren’t vaccinated. Check your policy carefully—just because you had coverage last year doesn’t mean it's automatic now.

Coverage Variations Among Insurance Providers

Major insurers like Allianz, World Nomads, and AXA have different policies. Allianz now offers a COVID-19 Protection Plan in certain countries, including trip cancellation and health coverage. World Nomads tends to include COVID coverage in their standard plans, but with restrictions. AXA has a dedicated COVID-19 rider that can be added separately. Comparing these can save you from surprises.

Geographic and Destination-Specific Policies

Some countries or states require travelers to have specific COVID policies. High-risk areas, like certain parts of Asia or Africa, might have extra restrictions or exclusions. Always check if your destination has special rules on COVID coverage before booking. Some policies won’t cover COVID-related issues in certain countries.

Impact of Evolving COVID-19 Variants and Public Health Guidelines

New variants, like Omicron, can still disrupt travel plans. Many insurers adapt policies based on public health advice. If your destination issues a travel warning or travel ban, your coverage may be affected. Staying updated on official alerts helps avoid losing protection unexpectedly.

How to Determine If Your Travel Insurance Covers COVID-19 in 2025

Reading and Interpreting Policy Documents

Look for clauses mentioning COVID-19 explicitly. Key phrases include "coverage for coronavirus," "pandemic-related costs," or "public health emergencies." If something isn’t clear, ask your insurer directly. Clear understanding prevents surprises when you need it most.

When and How to Purchase COVID-19 Inclusive Policies

Buy your insurance early—preferably well before your trip, so coverage kicks in when you need it. Policies purchased after travel start often don’t include COVID coverage. Always review the terms and ask about pandemic-specific protections before finalizing.

Does Purchasing a Separate COVID-19 Insurance Add-On Make Sense?

Adding a dedicated COVID rider can be smart if your main policy doesn’t include coverage. This way, you get peace of mind. But, weigh the extra cost against how likely you are to need it. For frequent travelers or high-risk destinations, an add-on is usually worth it.

Practical Tips for Travelers in 2025

Actionable Steps Before Traveling

- Confirm your current coverage with your insurer.

- Keep a copy of your policy and any COVID-related provisions.

- Vaccinate if possible, and understand quarantine rules for your destination.

- Read travel advisories from official sources.

During Your Trip

- Know how to access medical help abroad.

- Follow local health rules and safety protocols.

- Stay updated on any restrictions or changes.

- Keep receipts and documents if you need to file a COVID claim.

Post-Travel Considerations

If you catch COVID after returning, report it quickly to your insurer. Provide all requested documents to speed up claims. Keep track of any updates to your policy during your trip.

Future Outlook: Will COVID-19 Coverage Continue to Be Standard?

Expert Opinions and Industry Predictions

Most experts believe COVID-19 coverage will stay in policies but become more integrated. Insurers are moving toward more comprehensive health protection, blending travel and health insurance. Expect a trend toward plans that handle not just COVID but other health risks as well.

Regulatory and Policy Changes on the Horizon

Governments are considering mandates requiring travel insurance to cover pandemics. Some countries already have rules in place. Regulations may tighten, making COVID coverage a must in most policies. This should make travel safer but also more predictable.

Recommendations for Travelers Moving Forward

Stay alert! Regularly review your policies and stay informed about changes. Consider adding comprehensive health coverage for peace of mind. That way, when you travel in 2025, you're covered no matter what.

Conclusion

Travel insurance coverage for COVID-19 in 2025 is more common but still varies by policy and provider. Many plans now include pandemic protection, but always check the specifics. As the world adjusts to living with COVID-19, being proactive about your coverage keeps travel stress-free. Review your policy carefully, ask questions, and stay updated. Being prepared means more fun and less worry when exploring new destinations. Make sure your travel plan includes the right COVID-19 coverage — because knowing you're protected is priceless.